Auto Lease

Car Leasing Tips

Hybrid Cars - Electric vehicles

Understanding Marketing Tax Deduction

The History And Principles Of Insurance

What Does Your Credit Rating Say About You

Browse All Our Informative Topics

InternetBusinessIdeas-Viralmarketing Home Page

Single-Payment Lease

Auto lease: A prepaid lease is an innovative type of lease which has made its way into the market in recent times. With this type of lease, consumers forgo the cycle of lease payments if they make a large payment at the beginning of the lease. There are two amounts in a conventional lease that incur charges and determine your monthly lease payments.

Auto Lease

First, there is a depreciation charge which accounts for the value the car loses during the lease term. Second is a residual amount which is the projected value of the vehicle at the end of the lease. The sum of these two charges gives the monthly payments on your lease.

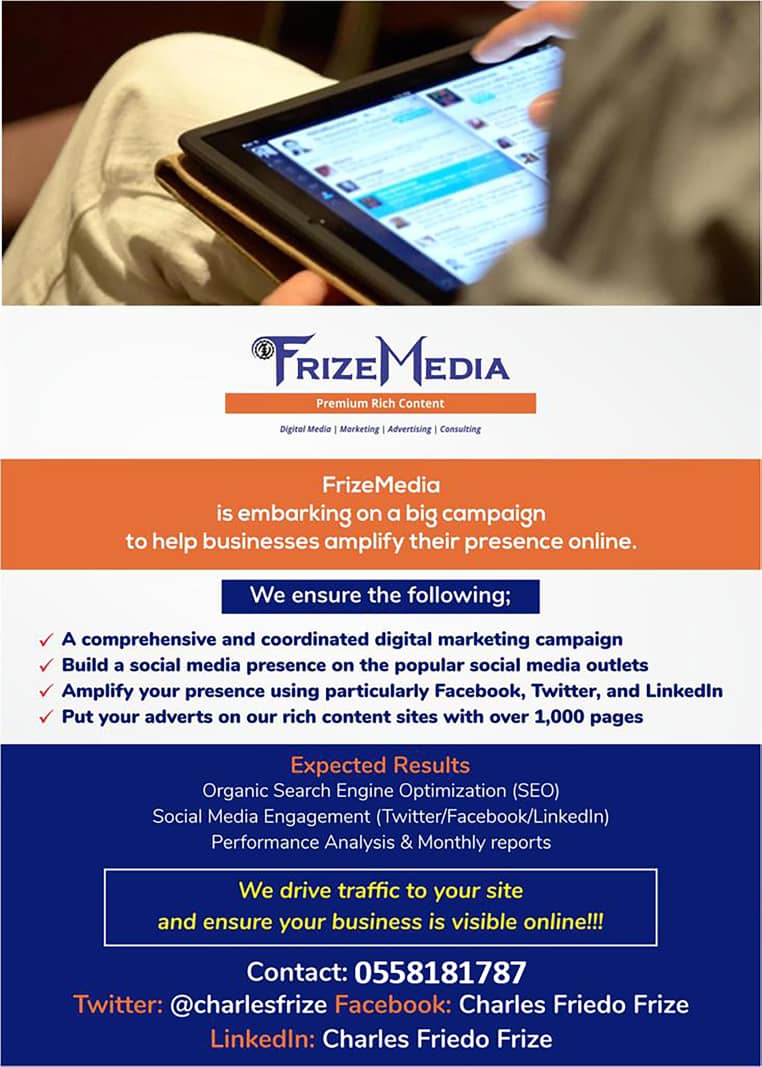

FrizeMedia Ghana SEO SEM Digital Marketing Proposal

The Best And Top Digital Marketing And SEO Services In Ghana

The idea behind a pre-paid lease is to eliminate the finance charges for depreciation and only account for residual value charges in a single, pre-paid payment at the beginning of the lease. Single-payment leases are devised with spendthrifts in mind: no cycle of monthly payments, a new car every two to three years and no interest in purchasing the vehicle at the end of the lease. You should only consider this type of lease if you are concerned about not being able to make monthly payments and have a lot of cash upfront.

Auto Lease - Guide

Leasing And Your Credit Score. Your credit score is part of the leasing decision. When

you apply for a lease, your lease company will typically look at your

credit score to decide whether to approve the application.

The leasing contract stipulates that you make regular, monthly payments over your lease term. The credit score your lease company requests identifies how likely you are to make such payments. It is simply a number calculated according to a model that takes into account your payment history, any amounts you owe and credit currently in use.

It is very important to keep a good credit-score, usually above 700, to qualify for a lease or any other lending decision. Start by ordering your credit report. If erroneous data is held about you, then contact the creditor responsible and get such information corrected. Your payment history is the single most important factor in determining your credit score, so get in the habit of paying everything you owe on time and keep the balances low in your credit cards.

Tweet

Follow @Charlesfrize

New! Comments

Have your say about what you just read! Leave a comment in the box below.