Forex Market Trading

10 Reasons To Start Forex Market Trading

Forex market trading: There are increasingly many well informed investors and entrepreneurs diversifying their

traditional investments like stocks, bonds & commodities with foreign currency because of the following reasons.

10 REASONS TO START TRADING FOREX! 1) FOREX is the largest financial market in the world. With a daily trading volume of over $1.5 trillion, the spot FOREX market can absorb trading sizes that dwarf the capacity of any other market. In fact, when compared with the $50 billion daily market for equities or the $30 billion futures market, it becomes quickly apparent this gives you, and millions of other FOREX traders, almost infinite trading liquidity and flexibility.

2) FOREX is a True 24-hour market. The FOREX Market never sleeps. Trading positions can be entered and exited at any moment around the globe, around the clock, 5.5 days a week. There is no waiting for an opening bell as in the case of trading stocks. It is a 24- hour, continuous electronic (ONLINE) currency exchange that never closes. This is very desirable for you if you want to trade on a part-time basis, because you can choose when you want to trade: morning, noon or night.

3) There is never a Bear Market in FOREX. You can have access to a seamless exchange of currencies. Currencies trade in "pairs" (for example, US dollar vs. JPY (YEN) or US dollar vs. CHF (Swiss franc), one side of every currency pair (for example, USD/CHF) is constantly moving in relation to the other. Thus, when you buy a particular currency, you are actually simultaneously selling the other currency in that particular pair. As the market moves, one of the currencies will increase in value versus the other. Of course, it is up to you to choose the correct currency to be long ( you bought) or short( you sold).

4) High Leverage - up to 400:1 Leverage. You are permitted to trade foreign currencies on a highly leveraged basis - up to 400 times your investment with some brokers. Standard 100,000- US$ currency lots can be traded with as little as 0.25% margin, or $250. Mini FX accounts are permitted to trade with just 0.25% margin, meaning, just $25 allows you to control a 10,000-unit currency position. Futures traders, who are accustomed to margin requirements generally equal to 5-7%-8% of the contract value, will immediately recognize that the FOREX market provides much greater leverage, and for stock traders, who must post at least 50% margin, there’s no comparison. If you’re looking for an efficient use of trading , trade the Forex Market.

5) Price Movements might be Highly Predictable. Currency prices in the FX market generally repeat themselves in relatively predictable cycles, creating trends. The strong trends that foreign currencies develop are a significant advantage for traders who use the "technical" methods and strategies. Unlike stocks, currencies have the tendency to develop strong trends. Over 80% of volume is speculative in nature and, as a result, the market frequently overshoots and then corrects itself. As a technically-trained trader, you can easily identify new trends and breakouts, to enter and exit positions.

6) YOU don't pay commissions or fees to trade FOREX. When you trade FOREX through some brokerages, you can do it totally FREE of commissions and fees , regardless of your account size. Some require a very low minimum amount to open a brokerage account, only US$ 200 and they do not charge commissions or fees to trade or to maintain an account, regardless of your account balance or trading volume.

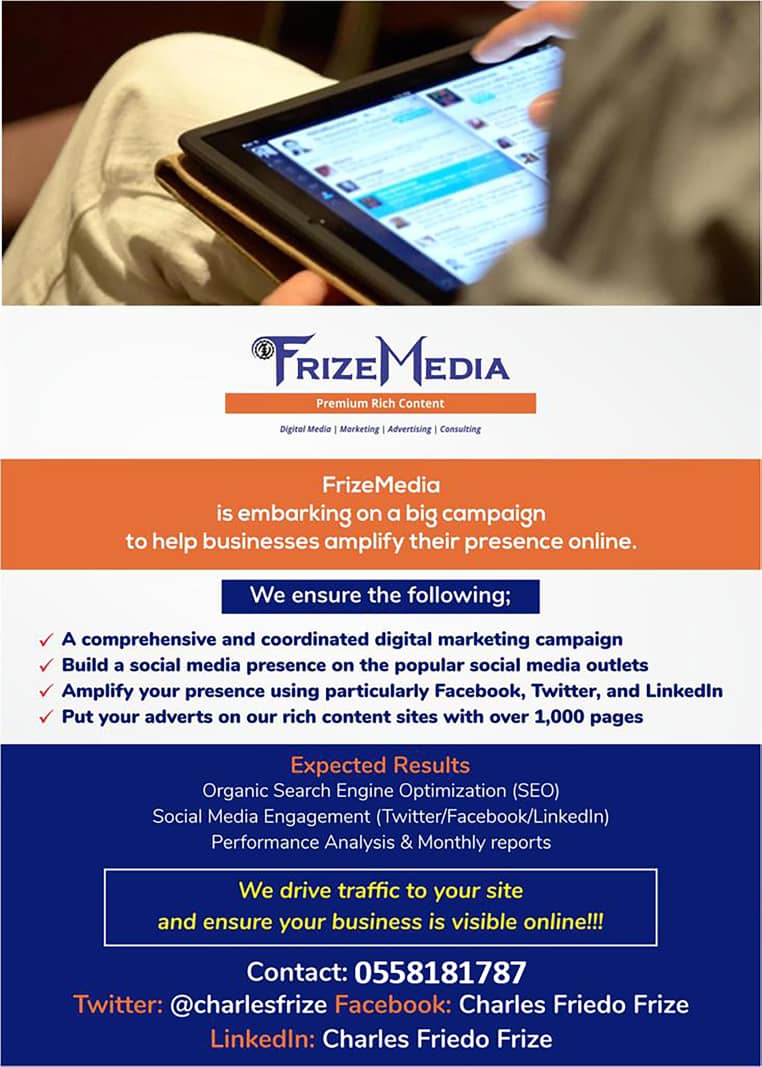

FrizeMedia Ghana SEO SEM Digital Marketing Proposal

The Best And Top Digital Marketing And SEO Services In Ghana

7) YOU don't have to pay trading fees or exchange fees. There are none of the usual fees, which futures and equity traders are accustomed to pay. NO exchange or clearing fees, NO NFA or SEC fees. Because currencies trade over-the-counter (OTC), via a global electronic network, in FOREX, what you see on your trading screen, is what you get, allowing you to make quick decisions on your trades without having to worry or account for fees that may affect your profit/loss or slippage. In the equity and commodity markets, you must pay both a commission and exchange fees. The over-the-counter structure of the FX market eliminates exchange and clearing fees, which in turn lowers transaction costs.

8) HOW do Forex brokers make money if they don't charge commissions? Like all traded financial products, over-the-counter currency trading involves a bid/ask spread, which represents the prices at which your counterpart is willing to trade. Your broker will receive a part of this bid/ask spread. Because the currency market offers round-the-clock liquidity, you receive tight, competitive spreads both intra-day and night. Stock traders can be more vulnerable to liquidity risk and typically receive wider trading spreads, especially during after-hours trading.

9) Market Transparency. Market transparency is highly desired in any trading environment. The greater the market transparency, the more efficient the market becomes. Unlike other markets where transparency is compromised (like in the many recent scandals), FOREX markets are highly transparent (i.e., analyzing countries, and having access to real-time research / news, is easier than analyzing companies). Because of this transparency, as an FX trader, you will be able to apply risk management strategies in accordance to your fundamental and technical indicators.

10) Instantaneous Order Execution. The FX market offers the highest level of market transparency out of all the financial markets. Because of this, order execution and fill confirmation usually occur in just 1-2 seconds. In Forex, order execution is all-electronic and because you'll be trading via an Internet-based platform, instantaneous execution is routine. There are no exchanges, no traditional open-outcry pits, no floor brokers, and consequently, no delays.

How To Start Trading The Forex Market

Forex Trading School - Understanding Forex Trading

Choosing A Forex Trading System

Browse All Our Informative Topics

InternetBusinessIdeas-Viralmarketing Homepage

Tweet

Follow @Charlesfrize

We Are Helping 1000 Businesses Amplify Their Online Presence