Mortgages

Effects Of Interest Rates

Mortgages: Interest rates can affect the type of mortgage you choose and dictate when it’s wise to make a change. Here are a few of the factors that can be affected by a swing in interest rates:

Choosing A Mortgage When interest rates are rising, a fixed-rate mortgage is usually a good choice, since it locks in the current rate and protects you from the higher rates to come.

When rates are falling, an adjustable-rate mortgage (ARM) becomes more attractive, as its interest rate changes periodically (usually every one, three, or five years), allowing you to benefit from the new, lower rates. A number of people choose an ARM even when rates are rising. This is because the interest rate on an ARM is substantially lower -- as much as two percentage points lower than that of a 30-year fixed-rate mortgage.

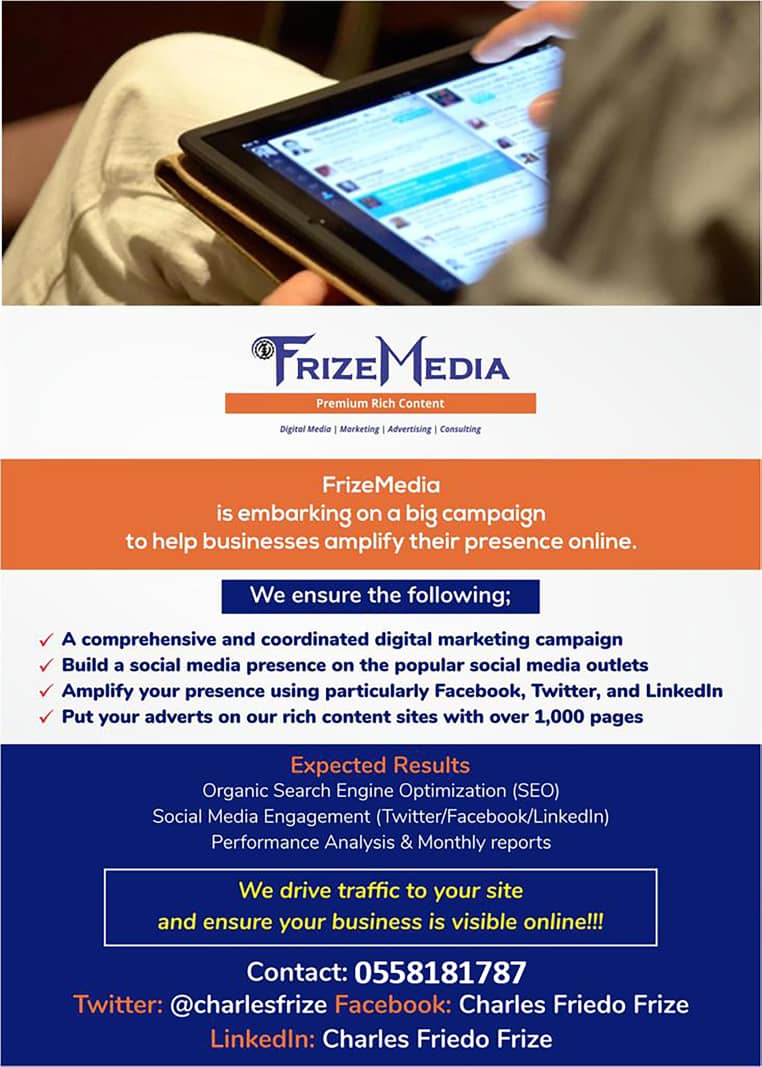

FrizeMedia Ghana SEO SEM Digital Marketing Proposal

The Best And Top Digital Marketing And SEO Services In Ghana

That means you’ll pay less until mortgage rates have increased a full two percentage points. After that, you’ll pay more than a fixed rate. There are also hybrid ARMs, which have a fixed rate for a certain time period -- typically three to 10 years -- and then become adjustable. (A 5/1 ARM, for example, has a fixed rate for five years, after which the interest rate is adjusted annually.)

Hybrid ARMs can be the right choice if rates are likely to rise in the short-term but then flatten or fall. However, these long-term trends can be difficult to predict. When rates are falling, you can save money by moving from a fixed-rate to an adjustable-rate mortgage, so you can benefit from the lower rates.

Refinancing A change in the interest rate trend can make it worthwhile to switch to a different type of mortgage. If interest rates appear set for a sustained rise, switching from an ARM to a fixed-rate mortgage can lock in a lower rate and protect you from higher payments. However, you should make sure that any closing costs does not offset the benefits of refinancing.

What Does Your Credit Rating Say About You?

10 Reasons To Start Forex Market Trading

Leasing Is Often Better Than Buying

An Overview Of The Stock Market

Browse All Our Informative Topics

InternetBusinessIdeas-Viralmarketing Home Page

Tweet

Follow @Charlesfrize

New! Comments

Have your say about what you just read! Leave a comment in the box below.