Trending Topics on Cryptocurrencies and Crypto Wallet across FrizeMedia

Singapore Sharpens Its Digital Finance Focus: Tokenization in, Speculative Crypto Out.

Ripple’s Flagship Stablecoin Approved for Use in Dubai’s Premier Financial Hub

The regulatory greenlight strengthens Ripple’s presence in Dubai, accelerating innovative cross-border payment solutions.

Key Highlights

- Ripple’s RLUSD stablecoin has been approved by the Dubai Financial Services Authority (DFSA) for use within the Dubai International Financial Centre (DIFC).

- The UAE is experiencing rapid stablecoin adoption, with surging demand from businesses for cross-border payments and digital asset solutions.

Regulatory Milestone

The DFSA, which regulates the DIFC, has officially approved Ripple USD (RLUSD) for use in the financial hub. This endorsement places RLUSD among an elite group of stablecoins with dual regulatory approval in both Dubai and New York (under the NYDFS).

With this approval, Ripple can now integrate RLUSD into its DFSA-licensed payments infrastructure. The company secured its first Middle Eastern license in March 2024, allowing it to offer crypto payment services in Dubai—a strategic move into the UAE’s $40 billion cross-border payments market.

The latest approval also enables over 7,000 DFSA-regulated firms in the DIFC to incorporate RLUSD into their virtual asset services.

Enterprise-Grade Stablecoin Adoption

Jack McDonald, SVP of Stablecoins at Ripple, emphasized that RLUSD is designed as a "regulation-first, enterprise-grade" stablecoin for global business.

"The DFSA’s approval validates our vision. RLUSD is uniquely positioned to drive institutional blockchain adoption, starting with cross-border payments," McDonald stated.

Since its late 2024 launch, RLUSD’s market valuation has surpassed $310 million (CoinGecko data).

UAE: A Global Leader in Digital Asset Innovation

Stablecoin adoption in the UAE has surged, with 2024 transaction volumes growing 55% YoY, a testament to the region’s booming $400+ billion international trade market.

Reece Merrick, Ripple’s Managing Director for MEA, noted:

"The UAE continues to set the global standard for digital asset regulation. DFSA’s approval of RLUSD marks another milestone for Ripple in the region, with strong demand from businesses for cross-border payments and custody solutions."

Expanding Regional Footprint

Ripple recently onboarded its first UAE-based customers, Zand Bank and Mamo, for regulated blockchain payments. Additionally, it is collaborating with Ctrl Alt on the Dubai Land Department’s Real Estate Tokenization Project, which will digitize property deeds on the XRP Ledger.

Why This Matters

- Regulatory credibility: Dual approval in NY and Dubai cements RLUSD’s compliance-first approach.

- Market expansion: Access to the DIFC’s 7,000+ firms accelerates institutional adoption.

- UAE’s crypto leadership: Progressive policies position Dubai as a global hub for blockchain innovation.

This development underscores Ripple’s growing influence in MEA and South Asia, leveraging stablecoins to revolutionize cross-border transactions.

Two Digital Currencies Poised To Achieve A $1 billion Valuation In The First Quarter Of 2025

With Bitcoin (BTC) bouncing back after the Federal Reserve opted to maintain interest rates, market sentiment has shifted towards optimism once more, following an extensive sell-off. During this resurgence, certain altcoins are displaying significant upward potential.

Supported by strong fundamentals, increased adoption, and rising community interest, these digital currencies may experience additional gains if the bullish trend persists. Finbold has highlighted two cryptocurrencies that are on the brink of reaching the $1 billion market cap threshold, a significant milestone that could indicate their next phase of expansion.

Helium (HNT) is presently valued at $4.25, boasting a market capitalization of $753.05 million. To reach the $1 billion market cap milestone, it requires an additional $246.95 million, necessitating a price rise to roughly $5.65.

The network's user base is expanding rapidly, now surpassing 400,000 active users each day, which signifies a robust growth phase. Helium is broadening its reach through collaborations, notably with DAWN, a platform dedicated to decentralizing internet services.

This partnership aims to create a 'decentralized last-mile internet,' with the network poised to gain 8,000 additional nodes. On the technical side, HNT has surpassed a long-standing resistance line, with experts predicting a considerable upward potential and aiming for an impressive 1,050% growth. If the adoption trend continues and technical momentum increases, Helium seems well-positioned to exceed the $1 billion market cap in the near future.

Jito Protocol (JTO), currently valued at $3.33 per token and boasting a market capitalization of $961.41 million, is nearing the $1 billion threshold. The rising interest in its liquid staking offerings on Solana (SOL) is contributing to this growth.

As reported by DeFiLlama, Jito's total value locked (TVL) has climbed to $3.837 billion, highlighting increased investment flows into the platform. Additionally, information from TokenTerminal reveals that Jito has accumulated over $270 million in fees, indicating heightened network activity. Experts maintain an optimistic outlook on JTO’s price movement, pinpointing critical breakout thresholds at $3.224, $3.460, and $3.694, with potential for further gains if momentum persists.

With robust adoption and strong bullish momentum, HNT and JTO are on a path to exceed a market capitalization of $1 billion by the first quarter of 2025.

Binance banned in City watchdog crackdown on major cryptocurrency exchange

Ripple seeks docs from 15 offshore exchanges it says could be ‘fatal’ to the SEC’s charges

Goldman Sachs: Bitcoin Is an Alternative Inflation Hedge to Copper, Not Gold

The recent progress in the field of digital currencies has piqued the interest of investors and enthusiasts. The increasing popularity of cryptocurrencies highlights the significance of staying up to date with the latest trends and advancements in the sector. One important factor to consider when it comes to digital currencies is choosing the most appropriate wallet option.

In this fast-paced digital age, staying up-to-date with the latest information on digital currencies is crucial. That's where FrizeMedia comes in. We provide a comprehensive and reliable source of news and insights on this exciting subject. Our team of experts constantly monitors the market and brings you the most relevant and timely information.

Whether you're a seasoned investor or just starting to explore the world of digital currencies, FrizeMedia is the perfect platform to expand your knowledge. With our easy-to-use interface, you can access a wealth of resources and articles that cover everything from the basics of digital currencies to advanced trading strategies.

A digital wallet acts as a secure storage solution for cryptocurrencies, enabling users to safely store, send, and receive their digital assets. There is a wide range of wallet choices available in the market, each catering to different requirements and preferences. Some commonly used options include hardware wallets, software wallets, and online wallets.

Hardware wallets, like Ledger Nano S and Trezor, are physical devices that store the user's private keys offline, providing an additional layer of protection against online threats. Conversely, software wallets are applications or programs that can be installed on a computer or mobile device. Examples of software wallets include Electrum and MyEtherWallet. Online wallets are cloud-based solutions accessible through a web browser, with Coinbase and Binance being well-known platforms in this category.

When choosing a wallet, it is crucial to take into account aspects such as security features, ease of use, and compatibility with various cryptocurrencies. By staying informed about the latest advancements in digital currencies and selecting the most effective wallet option, users can secure the safety and accessibility of their cryptocurrency investments. It is essential to remain alert in the constantly changing landscape of digital assets to make informed decisions that align with individual needs and preferences.

South African brothers vanish along with $4.8 billion of Bitcoin

The brothers halted their operations in April, along with a message to investors that Africrypt had been hacked and funds were missing

JOHANNESBURG (BLOOMBERG) - The Cajee brothers, who ran a cryptocurrency investment platform from South Africa that the local regulator suspects of being a Ponzi scheme, are confounding both their family and desperate investors alike. Ameer and Raees Cajee, the pair that operated Johannesburg-based Africrypt since 2019, appear to have vanished, along with an estimated US$3.6 billion (S$4.8 billion) in Bitcoin, after telling investors the exchange had been hacked. This would go down as the largest cryptocurrency loss in history if the money cannot be recovered, said Fortune magazine on its website. All totaled, about 69,000 Bitcoins are missing from the firm. While they were worth US$3.6 billion at the time of their disappearance, with recent drops, the value of that wallet currently stands at just under US$2.4 billion, said Fortune. Attorney Gerhard Botha, who's working on the firm's liquidation case, said some of his clients last made contact with the brothers in May, and he was able to reach them before court proceedings kicked off in Johannesburg. But no "proactive response" was forthcoming from them, Mr Botha said. A "To Let" sign could be spotted on Saturday (June 26), fastened to a glass door of vacant office premises in Johannesburg's upmarket Rosebank business hub that were listed in Africrypt's communication with clients.

Their cousin, Zakira Laher, said she was last able to make contact with the brothers in April and no one knows where they are. Raees Cajee directed all questions to a lawyer, John Oosthuizen, who wasn't immediately available to comment. While Ms Laher, 31, worked for the brothers briefly, she resigned from Africrypt in 2019 - her role was only to do some administrative work and provide legal advice as the company was getting started. The brothers liked a "nice lifestyle," filled with luxury cars and traveling - nothing unusual considering they started making money with crypto ventures at an early age, she said. The brothers halted their operations in April, along with a message to investors that Africrypt had been hacked and funds were missing. A lawyer assisting some of the clients said the missing Bitcoin totaled as much as US$3.6 billion. Another firm, working on bankruptcy proceedings, said they are aware of about 62 clients that have about 140 million rand (S$13.3 million) at risk - and possibly more coming forward. Read more...

European Union to Release Digital Wallet for Payments Next Year

The European Union (EU) will launch a digital wallet allowing citizens of any country in the bloc to make payments and access services provided by each state, also allowing for the storage of digital ID information. The wallet, which will reportedly be launched next year, could be tied in with the digital euro project, a central bank digital currency (CBDC) proposal that the ECB is still working on.

The European Union has plans to release a digital wallet that would allow its citizens to make payments across all member states with minimal friction. The wallet would be launched next year and integrate private and public services under just one app, according to a report from Reuters. The wallet would work as a sort of payments and ID vault, and would allow users to store digital equivalents of their physical permits, such as passports or driver’s licenses, integrating other state-dependent services too. Due to its character, the wallet will be authenticated using biometric data, such as fingerprint verification and retina scans using computational power and sensors that mobile devices already have on board. Read more...

Building Empires: Biggest Crypto Exchanges Push for Global Presence

Cryptocurrency exchanges have an important role in driving adoption around the world, but even the biggest operations face significant challenges when trying to expand their services. The advent of Bitcoin (BTC) and the subsequent development and launch of numerous other cryptocurrencies have changed the way people look at transacting across the world. Dependency on traditional banking systems is no longer the only option available to people.

Blockchain networks and cryptocurrencies are able to bypass conventional financial systems and allow people to transact directly, without having to go through a centralized institution. In an ideal, cryptographically secure world, users would transact peer-to-peer, but there are some barriers to entry for the uninitiated. Therefore, most of those new to crypto use exchanges as their entry points into the ecosystem as they convert their fiat currency into their cryptocurrency of choice. In 2020, users are spoiled by choices with the sheer number of cryptocurrency exchanges operating internationally. Nevertheless, a handful of these exchanges are attempting to surge ahead of the pack and establish themselves as truly global enterprises. But what are the key challenges they face, and how have they gone about building their respective empires? Read more...

Chinese traders turn to OTC desks amid regulatory crackdown

Threats from China’s central government appear to have done little to quash local demand for crypto assets.

As Beijing attempts to regulate and suppress the cryptocurrency boom, traders have been evading regulatory oversight by using over-the-counter, or OTC trading desks. According to a May 31 report published by Bloomberg, there has been a significant uptick in OTC platform usage since China announced its latest crackdown earlier this month, with China tightening restrictions prohibiting financial institutions and payment companies from providing services related to cryptocurrencies. While exact volume data is hard to ascertain as Chinese OTC transactions are peer-to-peer and use third-party payment platforms, the exchange rate between China’s yuan and popular stablecoin Tether (USDT is seen as a key gauge of local crypto market sentiment — with demand for USDT increasing during market downturns.

According to Bloomberg, USDT/CNY fell by as much as 4.4% after the Communist Party crackdown earlier this month but has since recouped more than half the loss. The recovery suggests that peak selling may have passed as the markets begin to consolidate. One of the concerns driving China’s crypto crackdown is capital outflows, which have been seen to spur their latest moves to suppress the industry. Bloomberg speculated that OTC trading may not pose the same capital flight risks associated with typical exchanges, suggesting regulators may not be so heavy-handed in dealing with the sector. Read more...

Will Tesla Dump Its Bitcoin Holdings This Quarter?

Did China Ban Crypto? Crackdown Explained As Bitcoin and Other Cryptocurrencies Crash

Hodlnaut Announces New Token Swap Feature

Wharton receives $5 million Bitcoin donation, the Largest crypto Donation in Penn History

Tech billionaire Mark Cuban invests in Indian blockchain Startup Polygon

Polygon said that it has now become a part of Mark Cuban’s company portfolio. Cuban, whose net worth is around $4.4 billion (as per Forbes) and has investments in over 100 companies

Mark Cuban is one of the prominent backers of cryptocurrencies, especially ether and dogecoin

NEW DELHI: US-based billionaire investor, Mark Cuban, has made an investment in Polygon — an Indian layer 2 ethereum scaling solution — the startup’s co-founder Sandeep Nailwal said. Polygon said that it has now become a part of Mark Cuban’s company portfolio. Cuban, whose net worth is around $4.4 billion (as per Forbes) and has investments in over 100 companies, is one of the prominent backers of cryptocurrencies, especially ether and dogecoin. “We have spoken to many investors, but the discussion with Mark Cuban was truly mind-blowing. It was so spectacular to know that the nuances of the industry, the tech and adoption we had figured out after months of grind, he was already thinking about those and had those questions in mind," Nailwal said without divulging the terms of the deal.

Polygon (formerly Matic Network) was co-founded in 2017 by three Indian software engineers — Jaynti Kanani, Sandeep Nailwal and Anurag Arjun. Mihailo Bjelic from Serbia was later added as a co-founder. Polygon is the first well-structured, easy-to-use platform for ethereum scaling and infrastructure development. The company aims to improve the usability and convenience of the current decentralized ecosystem. Ethereum, which is the base layer that Polygon uses, has come under criticism for having a high fee structure for enabling transactions. Layer 2 scaling projects such as Polygon help decentralized finance (DeFi) protocols bypass ethereum’s high transaction costs, which can open up the platform to more users. Read more...

Bitcoin is not for us, says HSBC Chief

HSBC has no plans to launch a cryptocurrency trading desk or offer the digital coins as an investment to customers, because they are too volatile and lack transparency, its chief executive Noel Quinn says. Europe’s largest bank’s stance on cryptocurrencies comes as the world’s biggest and best-known, Bitcoin, has tumbled around 40 per cent from the year’s high, after China cracked down on mining the currency and prominent advocate Elon Musk tempered his support. It marks it out against rivals such as Goldman Sachs, which Reuters in March reported had restarted its cryptocurrency trading desk, and UBS which other media said was exploring ways to offer the currencies as an investment product.

“Given the volatility we are not into bitcoin as an asset class, if our clients want to be there then of course they are, but we are not promoting it as an asset class within our wealth management business,” Quinn said. “For similar reasons we’re not rushing into stablecoins,” he said, referring to digital currencies such as Tether that seek to avoid the volatility typically associated with cryptocurrencies by pegging their value to assets such as the US dollar. Read more...

Elon Musk said crypto miners should post audits of the renewables they use to erase concerns over bitcoin's energy use. He was responding to Ark Invest's research director who says bitcoin mining encourages green energy use.

Bitcoin fell sharply to near $30,000 earlier this week after Tesla suspended bitcoin payments. Elon Musk said on Thursday top bitcoin miners should post audited data of the renewable energy they possibly use in order to ease concerns over the digital asset's impact on the environment. The billionaire was responding to a tweet from Ark Invest's director of research, Brett Winton, about bitcoin mining encouraging the adoption of renewables. The investment firm has argued bitcoin mining presents an opportunity to move away from fossil fuel consumption towards greener technology. "I agree that this can be done over time, but recent extreme energy usage growth could not possibly have been done so fast with renewables," Musk said in a tweet . "This question is easily resolved if the top 10 hashing orgs just post audited numbers of renewable energy vs not." He went on to say energy used through bitcoin mining is beginning to exceed that of medium-sized countries. "Almost impossible for small hashers to succeed without those massive economies of scale," he added.

Bitcoin uses around 121.36 terawatt-hours (TWh) per year, according to Cambridge University research . For comparison, banking systems consume 263. 72 TWh, while gold mining takes up around 240.61 TWh. That shows the other two industries consume twice the energy of bitcoin mining. Read more...

Bitcoin Recovers after China Crash – should you Buy or Sell?

After a wild 24 hours for Bitcoin one token now costs $40,000 Bitcoin dropped by as much as 28pc this week to trade at around $32,000 (£22,600) before bouncing back to $40,000. The sudden drop came after China's central bank warned financial firms about accepting cryptocurrencies as payment. In the trading frenzy, cryptocurrency exchanges including Binance, the world's largest, Coinbase and Kraken all struggled to handle surging demand for withdrawals. Other cryptocurrencies also plummeted, with Ethereum falling 32pc to $2,200, Ripple dropping 31pc to $1 and Dogecoin losing 42pc of its value, before then recovering. Bitcoin's bull run this year, which saw the digital currency hit a peak of more than $63,000 per coin, had been credited to a wave of support from large companies, such as Tesla, Mastercard and JP Morgan. A growing number of professional investors argue that Bitcoin, the oldest cryptocurrency and the largest by market value, deserves a place in a diversified portfolio.

Skeptics counter that Bitcoin has no intrinsic value as few people use it to buy things, it is unproven as a “safe haven” asset and faces the threat of legal clampdowns that could make it worthless. So should you buy some? And is it ever safe to do so? Investors should steer clear, according to Felix Milton of Philip J Milton, a financial planning firm, because governments could intervene at any moment and outlaw it as a currency, making it illegal to own. “At the moment it’s allowed to operate but that may not last forever,” he said. “I would strongly advise against investing unless it becomes regulated by the Government. “If this happened, it would reduce price volatility and legitimize it as an investment. But right now it is too risky to own as a serious investment and is more of a gamble.” Read more...

U.S. Treasury Calls for crypto Transfers over US$10,000 to be Reported to IRS

The U.S. Treasury said the Biden administration’s proposal to strengthen tax compliance includes a requirement for transfers of at least US$10,000 of cryptocurrency to be reported to the Internal Revenue Service. “As with cash transactions, businesses that receive cryptoassets with a fair-market value of more than US$10,000 would also be reported on,” the Treasury Department said in a report on tax-enforcement proposals released Thursday.

The Treasury said that comprehensive reporting is necessary “to minimize the incentives and opportunity to shift income out of the new information reporting regime.” It noted that cryptocurrency is a small share of current business transactions. Bitcoin pared a daily advance after the IRS announcement, which shaved about US$3,000 from the token’s price. It was up 5.7 per cent, at US$40,530 as of 4:23 p.m. in New York. Cryptocurrency-linked stocks like Coinbase and MicroStrategy also gave up some of their gains immediately after the news, which had also prompted an outcry from some digital-coin enthusiasts on Twitter.

“There was some major overreaction,” said Kristin Smith, executive director of the Blockchain Association trade group. “For those of us that believe we should try to keep crypto on par with how cash is treated – this does just that.” Cash transactions in excess of US$10,000 are already subject to IRS reporting requirements. The IRS in 2020 added a line about cryptocurrency on the Form 1040, the individual tax return, in an effort to gain more visibility into virtual currency transactions. Read more...

Altcoins Follow Bitcoin to the Abyss, XRP Lost 25%

The sell-off is anticipated to be triggered by the recent reiteration of the Chinese crypto ban. After the massive crash of Bitcoin and Ethereum, the market bloodbath has extended to the altcoin markets. Top altcoins like Binance Coin, Cardano, XRP, and others all moved lower in double-digits. Altcoins which still maintained gains after Bitcoin started its downward rush recently, all dived in the last few hours to several month lows. XRP, for instance, which spiked above $1.8 recently went below the $1 mark, but recovered a bit after that still with a 24-hour loss of around 25 percent, as of press time. Meme coins like Dogecoin and Shiba INU are also facing market wrath as both these coins went down by more than 21 percent and 32 percent, respectively in a day-chart.

Why China? Though factors like Elon Musk’s U-turn from Bitcoin rocked the market initially, the recent altcoin sell-off was mostly triggered by the latest reiteration of the Chinese ban on cryptocurrencies. “Virtual currency’s prices have soared and plummeted recently, resulting [in] a rebound of speculative trading activities of virtual currency,” a joint note issued by the China Internet Finance Association, China Banking Association, and China Payment and Clearing Association stated. “It has seriously damaged the safety of the people’s investment and damaged the normal economic and financial orders.” The three associations confirmed the government ban implemented in 2013 and 2017 that prevent any financial and payment institutions from offering services linked with crypto transactions. Read more...

Bitcoin Could be Near Support: Institutions Are Bullish Because Of Its Fundamentals

Bitcoin’s trend is generating debate among investors. Some think Bitcoin could continue to fall, but others remain bullish. Bitcoin has recently shifted trends, and this downturn has become a hot talking point among many investors who are divided between those who have fallen prey to pessimism and those who still refuse to believe that this was all a market episode started and extinguished by Elon Musk. After Elon Musk announced that Tesla had invested $1.5 billion in the purchase of Bitcoin, the markets began to go through the roof, and everything began to fall apart once he announced that Tesla would not accept Bitcoin because it was harmful to the environment. Now experts and analysts are in a war of ideas as they try to predict future scenarios. Carter Braxton Worth, Chief Market Technician at Cornerstone Macro, explained that Bitcoin might have some dark days ahead. The analyst, dubbed by CNBC as the Chartmaster, explained that Bitcoin could continue to fall until it finds support near $40,000. He argues that two key references are converging in that area: the 150-day Moving Average and the first resistance after the January 2021 peak. He explained that Bitcoin is currently in a historical support zone. Over its lifetime, Bitcoin has had 11 identifiable crashes over time. The average losses of these moments hover around 55% from the top – some have been over 80% while others have hovered around 30%. In other words, Bitcoin may currently be in a decisive support zone that could extend to around 35K should the 55% downtrend continue. Since the current ATH, Bitcoin has lost about 37%, losing all the gains since the second week of January 2021. Read more...

Forget Ethereum: This Investment Has Made Far More Millionaires

With this investment, you're more likely to become a millionaire -- with far less risk involved. Ethereum (CRYPTO:ETH) has been shattering records right and left. Over the past year, its price has soared by more than 1,600%. In the past month alone, it's up nearly 50%, as of this writing. It's even surpassed crypto king Bitcoin (CRYPTO:BTC), which has "only" increased 380% over the past year. If you're itching to jump on the cryptocurrency bandwagon, you're not alone. It's hard to ignore returns like these, and many investors are scrambling to buy crypto in an attempt to make a lot of money overnight. However, crypto is an incredibly risky investment, and it's more likely you'll lose money than become a millionaire. Although Ethereum has seen incredible gains over the past few months, that doesn't necessarily make it a good investment. There is one other type of investment, though, that's much safer -- and it's much more likely to make you a millionaire. Why is Ethereum so risky? All cryptocurrencies are risky because they are highly speculative. Many crypto supporters believe it will someday become a mainstream form of currency, which could disrupt the banking and finance industries. Right now, though, very few merchants accept crypto as a form of payment. In fact, only 2,300 U.S. businesses accept Bitcoin (which is the most widely accepted form of cryptocurrency), according to research from Fundera. Considering there are more than 30 million businesses in the U.S., that's only around 0.007% that accept Bitcoin as payment. Ethereum isn't quite as popular as Bitcoin, which puts it at even more of a disadvantage. Without widespread adoption, it will be challenging for crypto to see long-term success. Nobody knows what the future holds, so buying crypto right now is an incredibly risky move that may or may not pay off. Read more...

Billionaire Mike Novogratz shares his views on Bitcoin (BTC) and Crypto

Galaxy Digital’s CEO, Mike Novogratz, recently spoke about the state of the crypto industry and BTC. He noted that the current dip is nothing surprising given the massive price surges that pushed the value. He also addressed the efforts to make BTC greener, noting that all industries will use green energy.

The Bitcoin (BTC/USD) price nearly hit $65k around April 14th, which was more than a month ago, at this point. Since then, however, the coin has been moving down, spending a lot of time at the support level at $48k, only to briefly go up to $58k once again, and then, over the last week, it crashed by over 30%, currently sitting at $39,500. The crash came following Elon Musk’s appearance at SNL, or rather, his statement that came a day or so after the show. Musk said that Tesla will stop accepting BTC as a payment method for their electric cars due to the fact that Bitcoin mining is too impactful on the environment. Basically, BTC is not green enough. Commenting on the drop and this statement from Tesla, Galaxy Digital CEO, Mike Novogratz, said that this kind of behavior should not be surprising. There were some staggering moves on the positive side of things that brought BTC to heights that many would not dare imagine. Even its current price is twice the size of its 2017 record, and this is BTC that has crashed 30% in one week. The markets move up and down, according to Novogratz, and they do get ahead of themselves, which causes corrections. Crypto and blockchain are still being adopted by institutions and retail traders alike, so there is no reason to worry. As for the ESG (Environmental, Social, and Governance) side of things, Novogratz confirmed that they are real and that they will be addressed.

However, when asked about how quickly that can be done, Novogratz pointed out that, yes, Bitcoin uses a lot of electricity, but so do many other things that are worth something. The crypto ecosystem, which includes Bitcoin, is an important part of the future of finance, and so it should cost something, as he put it. Read more...

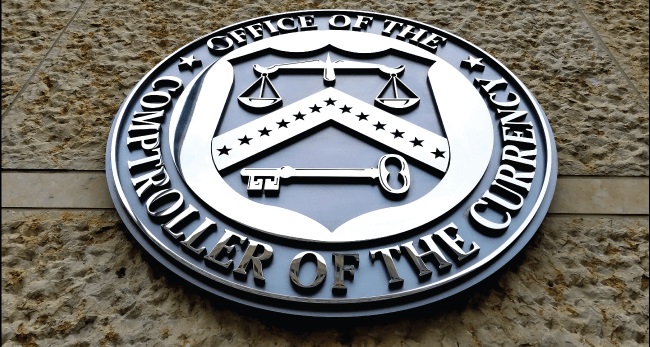

US Banking Regulator OCC Will Review Cryptocurrency Regulations

The Office of the Comptroller of the Currency (OCC) will review its cryptocurrency regulations, according to the interim head of the department, Michael Hsu. May 19, 2021, | AtoZ Markets – The new director of the US Office of the Comptroller of Currency, Michael Hsu, is calling for a revision of the agency’s earlier regulations regarding the cryptocurrency industry.

Michael Hsu, appointed this month as the interim head of the department by Treasury Secretary Janet Yellen, said in prepared remarks that he wants to take a tougher stance on cryptocurrencies than his predecessor Brian Brooks. Hsu has called for a review of several of the agency’s recent actions, including those that gave the OCC the authority to grant banking licenses to crypto custodians. “I am concerned that these initiatives were not implemented in full coordination with all stakeholders,” Hsu wrote in comments to the House of Representatives Financial Services Committee of the US Senate. “It looks like they weren’t part of a broader strategy related to regulatory boundaries either. I believe that solving both of these tasks should be a priority.” OCC is one of the divisions of the Ministry of Finance that regulates the activities of national banks and credit unions. Under the leadership of former CEO Brian Brooks, OCC has taken a crypto-friendly approach. In January, the OCC allowed U.S. banks and federal savings associations to use open blockchains and stablecoins to process payments.

Last fall, the OCC issued a clarification to American banks that they were allowed to hold funds to secure stablecoins, and before that, the agency allowed banks to provide cryptocurrency custody services. However, this approach of the OCC has displeased some politicians. Read more...

Will Tesla Dump Its Bitcoin Holdings This Quarter?

Tesla CEO could again be behind the 10% drop in bitcoin price after hinting that the company may be planning to dump BTC in reserves this quarter. May 17, 2021, | AtoZ Markets – After Elon Musk announced last week that Tesla would no longer accept Bitcoin payments for its luxury cars, the price of BTC nosedived roughly 17% in 24 hours.

Bitcoin hadn’t managed to fully recover before Elon sent out another tweet hinting that Tesla may be dumping some of its BTC holdings. “Indeed,” Musk responded to a post on May 16 that suggested Tesla could sell its BTC holdings this quarter. Musk’s popularity in the crypto community was already declining due to his criticism of Bitcoin’s energy efficiency and therefore Tesla’s suspension of BTC payments for vehicle purchases. This response further fueled the reactions of many prominent figures in crypto. Peter McCormack, the host of the What Bitcoin Did broadcast, said that Musk’s BTC criticism was “extremely ignorant”, while his support for Dogecoin made him “the perfect troll”. The Tesla CEO of criticism about this “Such discussions, directing me completely Doge” he made a statement. Yearn Finance developer ‘banteg’ suggested that Elon Musk plans to support Dogecoin against Bitcoin, first inflating the price of the cryptocurrency and then selling it.

The DOGE price has fallen 32% since May 8, when it hit its peak price of $0.73. The coin had begun to lose value rapidly since Elon Musk’s appearance on Saturday Night Live. On the other hand, Musk claimed that he understood money better than crypto analysts, as he previously held a managerial position at PayPal. Read more...

Tweet

Follow @Charlesfrize

New! Comments

Have your say about what you just read! Leave a comment in the box below.